We're talking a 'taboo' subject today and one that's still seen as inappropriate to be so brazen about. Finances I know. Snoozefest. But since Read More

Re-Resolutions | Reworking your goals after January

Congrats you made it to February fam. How are those resolutions coming on? Crap? Join the club. Despite the enthusiasm and renewed sense of Read More

3 Reasons To Start A Personal Journal

As the new year rolls in, I’m sure you’re inundated with dozens of self-improvement posts across the blogsphere - and are probably sick to death of Read More

Top 5 Friday | Female Fronted Podcasts

We seem to be in a renaissance period for podcasts (though I was admittedly ahead of the curve when I was a teenager listening to the likes of Read More

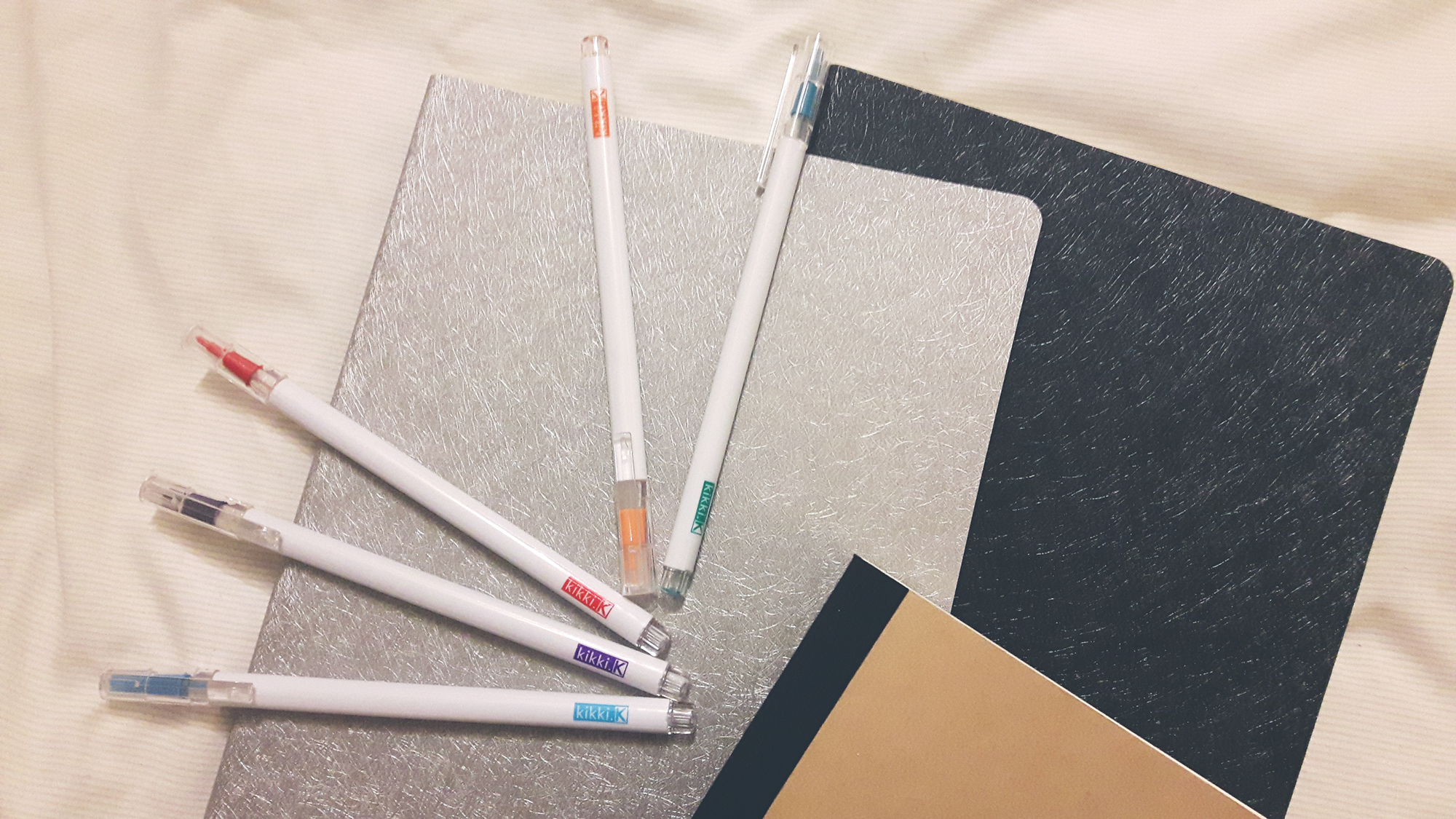

Wish List | Fresh Start Stationary

If there's one thing I truly miss about having an impending new school/college/uni year ahead of me now it's doing that annual Autumn stationary Read More

Top 5 TV shows you NEED to be watching on Netflix

Need a little distraction? Fancy procrastinating in front of your laptop for a few hours? Oh boy do I have some Netflix recommendations for Read More

An Ode To Independent Magazines

There’s no denying the print magazine industry is in a slight decline. Even publications like Vogue seem to be struggling as they turn to digital Read More

Inspiration | Colour Feature Walls

Happy Friday! Are you up for a little bit of lifestyle inspiration today fresh from my own Pinterest boards? Whilst, I of course love the idea of Read More

Haul | MCM Comic Con, London

Nerdy haul alert! I was at MCM Comic Con at London's Excel Centre this past weekend and like the n00b that I am I didn't take that many photos Read More

5 Things To Do On A Rainy Bank Holiday

We may be heading into June soon but this last Bank Holiday is looking seriously dodgy weather-wise. So why risk getting stuck in a rain shower in the Read More

23 | A Very Grown Up Birthday Wish List

It’s ma birthday tomorrow guys! Wahoooo! As I’ll be turning 23 I’m semi-trying to convince myself that I’m kinda-sort-of an adult so can legitimately Read More

Top 5 Soundtracks To Make You Fall In Love With Musicals

Hey guys, did you know I’m into musicals? (*cue sarcastic shouts of ‘Nah really Ria I had no idea?! That is brand new information to us!’) I’m a huge Read More